Calculation For Tax Incentive Pioneer Status

ITA is an incentive granted. 100 of SI 2 5 5.

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

It was created under the Nigerian Industrial Development Income Tax Relief Act IDA to incentivize qualifying entities.

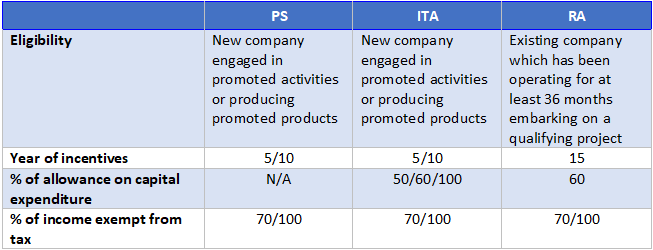

Calculation for tax incentive pioneer status. 60 QCE against 100 SI. Investment Tax Allowance ITA An allowance in addition to capital allowance of 60 100 on qualifying capital expenditure factory plant machinery or other equipment used for the approved project incurred within 5 to 10 years from the date the first qualifying capital expenditure is incurred. View calculation ps and ita docx from BKAT 3023 at Northern University of Malaysia.

The PSI grants an income tax holiday of up to five years three years initially and. The PSI grants an income tax holiday of up to five years three years initially and. The computations for pioneer status incentives are as follows.

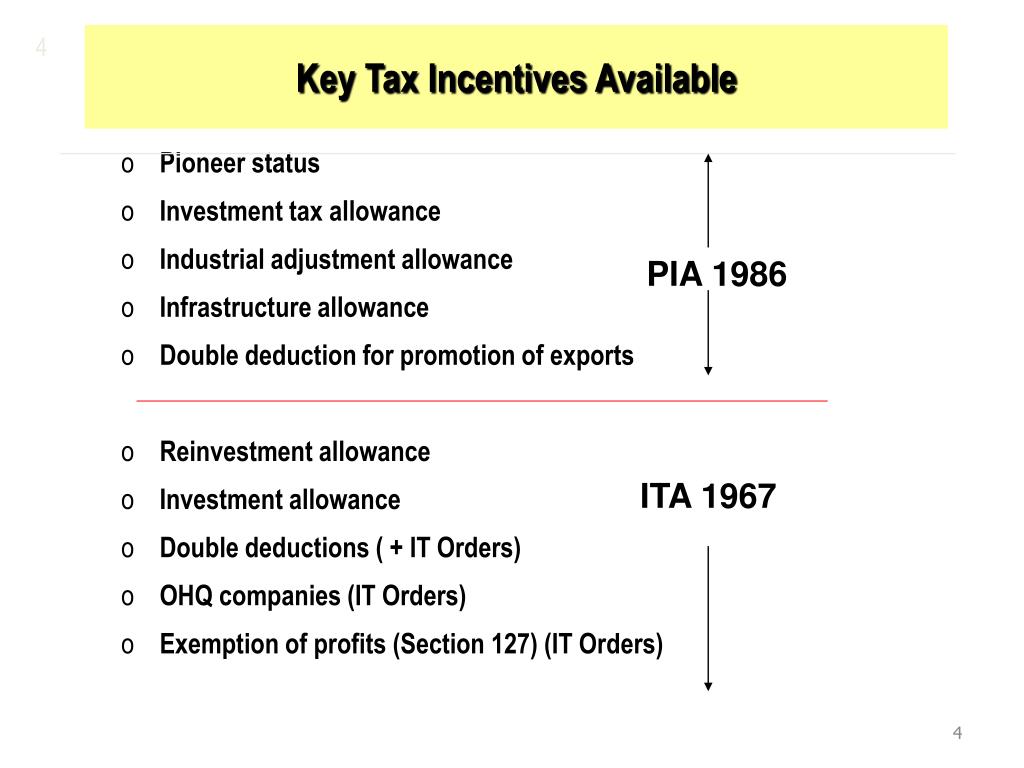

TAX317_Investment Incentives_Illustration Tapah COMPREHENSIVE EXAMPLE. The Pioneer Status Incentive PSI is a tax holiday provided founder IDITRA that grants qualifying industriesproducts relief from the payment of corporate income tax for an initial period of 3 three years renewable for 1 one or 2 two additional years. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years.

PSI for the creative industry covers cameras motion picture and slide projectors overhead transparency. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. In this regulation there is an additional charge.

The salient features of these incentives are discussed below. Unabsorbed capital allowances and accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer status of the company. Pioneer Status PS Income tax exemption of 70 100 of statutory income for 5 to 10 years.

PIONEER STATUS PS INCENTIVE Teras Sdn Bhd is a resident company involves in manufacturing digital audio recorder. Pioneer Status PS with tax exemption of 100 of statutory income for 10 years Investment Tax Allowance ITA of 100 on qualifying capital expenditure incurred within a period of 5 years to be utilized against 100 of the statutory income for each year of assessment Through Companies which incur capital expenditure for. Pioneer Status PS The PS incentive is given in the form of direct exemption of profit from the payment of income tax for a period of 5 years certain companies are given 10 years up to 70 certain companies enjoy 100 of a companys statutory income income after deduction of allowable expenses and capital allowances.

The period of tax exemption. Investment Tax Allowance ITA An allowance of 60 100 on qualifying capital expenditure factory. The pioneer certificate stated that the production day was.

In effect PSI seeks to enhance the survival profitability and sustainability of beneficiary companies. High-technology companies engaged in areas of new and emerging technologies. Generally tax incentives are available for tax resident companies.

Pioneer Status Incentive PSI is designed to reduce the cost of doing business in Nigeria by providing corporate income tax relief to qualifying companies making investments in industries designated as pioneer. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that generally provides for a deduction over and above capital allowances equivalent to 60 of the qualifying expenditure. TAX INCENTIVES B161 MAJOR CHANGES Pioneer Status Salient points.

100 QCE 3 against 100 SI. While pioneer status is an income-based tax incentive. These regulations came into effect on 30 January 2014.

The standard percentage is 30 but this is reduced to nil in some of the situations referred to below. TRP 1 Projects of national and strategic importance involving heavy capital investment and high technology. And must have incurred capital expenditure of not less than N10 million.

The company applied for a pioneer status tax incentive on 1 June 2019 and this was approved by the tax authorities. Special commencement and cessation rules apply and any other trade or business. It may provide up to 10 years of tax holiday.

The tax relief period commences on the production day of the PC production date equivalent to commencement of the pioneer enterprises commercial operations must be certified by regulator. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. In order to collect a measure of tax from certain pioneer companies the law deems a percentage of the statutory income of the pioneer business to be the total income or part of the total income of the company.

The alternative to pioneer status incentive is usually the investment tax allowance ITA. The NIPC recently released pioneer status incentive regulations. An applicant for the pioneer status must be a body corporate registered in Nigeria.

The Pioneer Status Incentive PSI is one of the available tax incentives in Nigeria aimed at attracting investment into critical sectors of the Nigerian economy. By improving location competitiveness the FGN is. Pioneer status is granted for an initial period of 5 years commencing from the production day as determined by the Ministry of International Trade and Industry MITI.

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. The Pioneer Status Incentive PSI is one of the available tax incentives in Nigeria aimed at attracting investment into critical sectors of the Nigerian economy. A service charge of 2 based on.

It was created under the Nigerian Industrial Development Income Tax Relief Act IDA to incentivize qualifying entities. Pioneer Status Incentive PSI is designed to reduce the cost of doing business in Nigeria by providing corporate income tax relief to qualifying companies making investments in industries designated as pioneer. ITA can be offset against 70 to 100 of the statutory income of the.

Manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the period of the exemption. In effect PSI seeks to enhance the survival profitability and sustainability of beneficiary companies.

Pioneer Status Tax Incentive i. The Pioneer Status Incentive was established by the Industrial Development Income Tax Relief Act No 22 of 1971 and is a tax holiday which grants qualifying industries and products relief from payment of corporate income tax for an initial period of three years extendable for one or two additional years. IDITRA prescribes tax free dividends to shareholders of PCs section 17.

Adjusted business income from a pioneer activity is fully exempted from tax.

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Posting Komentar untuk "Calculation For Tax Incentive Pioneer Status"